does maine tax retirement pensions

2021 HRB Tax Group Inc. Form 1099-B Proceeds from Broker and Barter Exchange Transactions Form 1099-DIV Dividends and Distributions From 1099-INT Interest Income Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc.

Maine Retirement Taxes And Economic Factors To Consider

Nonperiodic distributions from an employers retirement plan such as 401k or 403b plans are subject to withholding for federal income tax at a flat rate of 20.

. 20000 for those ages 55 to 64. No Estate Tax was imposed for decedents who died after January 1 2018. Form 1099-R Distribution From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc.

The state taxes income from retirement accounts and from pensions such as from MainePERS. If you are a resident or part-year resident of Maine filing Form 1040ME only to claim the property tax fairness credit andor the sales tax fairness credit you have no Maine income modifications on Form 1040ME Schedule 1A or Schedule 1S and you do not file a federal income tax return complete Maine Form 1040ME according to the. Nonperiodic distributions from an employers plan include lump-sum distributions even if those distributions may later be rolled over to another plan.

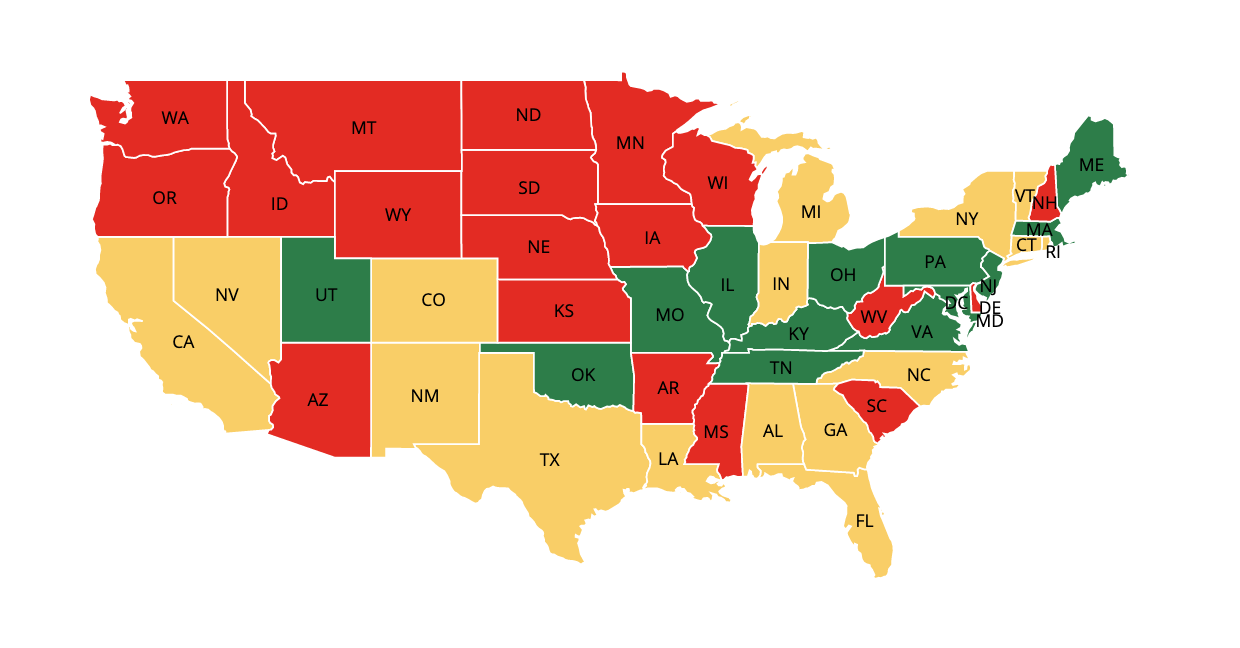

Up to 3500 is exempt Colorado. There may be a silver lining though. The types of Forms 1099 that you may encounter during the tax season are.

And 7500 for military retirees under age 55 increasing to 10000 in 2021 and 15000 in 2022 and 2023. Military retirement pay is partially taxed in. Up to 2000 of retirement income.

Military pensions are fully exempt for service members who retired before 1997. Otherwise up to 31110 in public pension income is. HR Block Maine License Number.

The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes. 1826-111 - 1125 Waivers Consent to Transfer. Up to 24000 of military retirement pay is exempt for retirees age 65 and older.

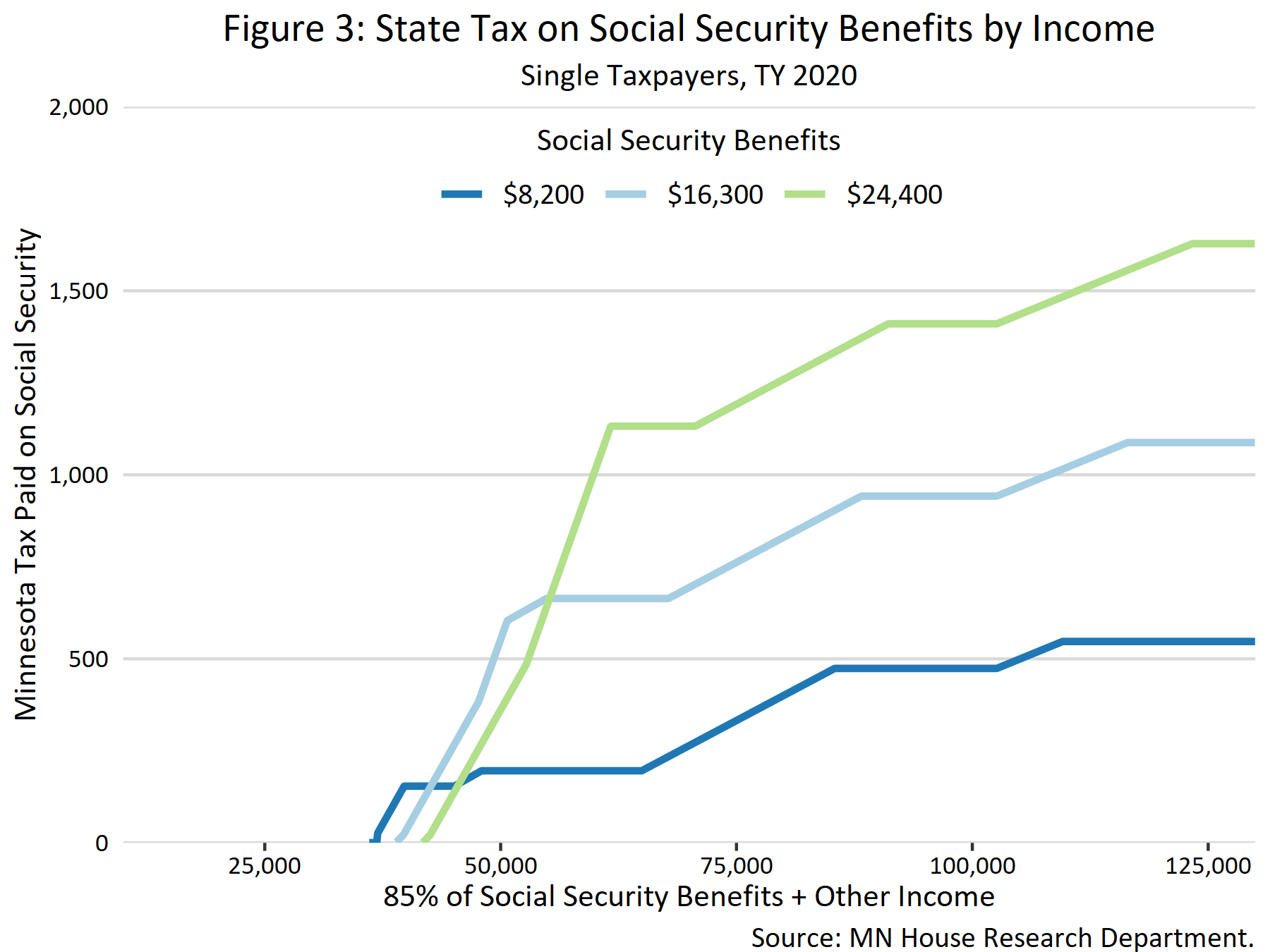

The state does not tax Social Security income and it also provides a 10000 deduction for retirement income. Form 1099-B Proceeds From Broker and Barter Exchange Transactions. For full details refer to NJAC.

Neither H. As our Maine retirement friendliness page will show you Maine is not the most tax-friendly state for retirees.

New Retirement Savings Law Will Benefit Maine Workers And Taxpayers

Benefit Payment And Tax Information Mainepers

Maine Retirement Tax Friendliness Smartasset

What Happens To Taxpayer Funded Pensions When Public Officials Are Convicted Of Crimes Reason Foundation

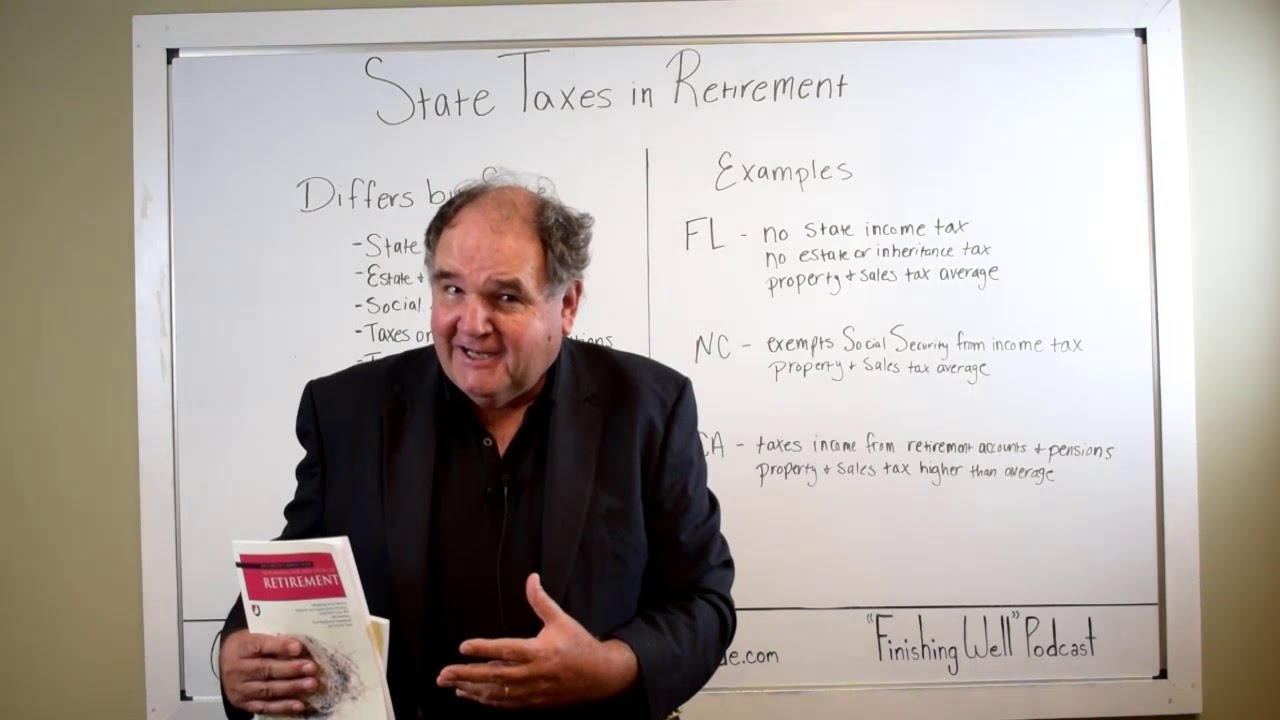

How Every State Taxes Differently In Retirement Cardinal Guide

Maine Lawmaker Wants To Remove Income Tax On State Pensions Wgme

States That Don T Tax Retirement Income Personal Capital

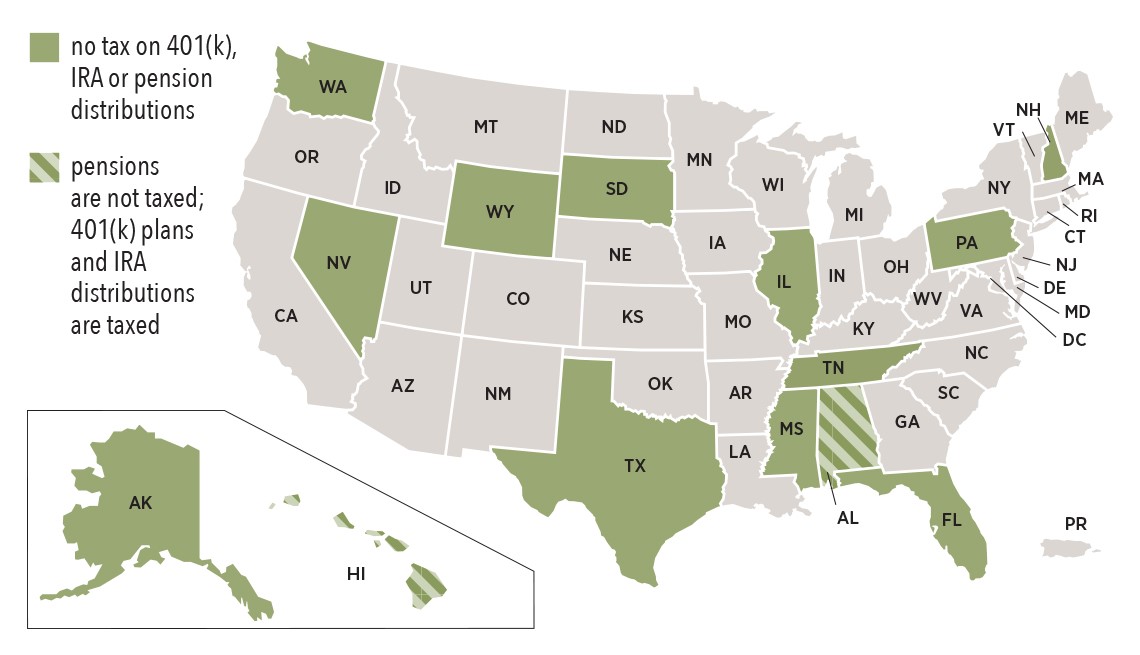

Retiring These States Won T Tax Your Distributions

Maine Retirement Tax Friendliness Smartasset

12 States That Keep Retirement Dollars In Your Pocket Alhambra Investments

How Every State Taxes Differently In Retirement Cardinal Guide

State Budget Contains Big Pension Improvements For Retirees Maine Afl Cio

Maine Retirement Tax Friendliness Smartasset